|

| 18-06-2009 11:44 PM | |

| Jeya |

http://www.salary.sg/2009/historical.../#comment-5039 Still the worst is not hit the people much. Its just in the market and investers pocket. Donít be tempt in the real estate now. This is not the bottom just one step free fall from the historic peak. It will slightly raise and then will crash.No more way to make easy money anywhere in the world. Be patient you are not going to miss the bus. If you take the bus know no could save you. |

| 04-06-2009 10:10 PM | |

| broadmind-- |

4852 what's happening now is oppotunistic buying to alleviate pent-up demand. once this is satisfied: 1. excess supply when more units get TOP in 2010 2. rental continue falling as more expats are sent home or have allowances slashed 3. developers lower prices to get sales it's unheard of for prices to rise in a recession i'm keeping all my cash and cpf now, and will continue to pay low rent until prices are less outrageous |

| 04-06-2009 01:49 PM | |

| quo-- |

4848 landlords can still hold now that interest is low, buyers won't bite if prices don't lower, renters can still rent since rental is low, so actually nothing will happen...all sides will happily stay status quo...agents will hv to look for another job though |

| 02-06-2009 03:10 PM | |

| landlord-- |

4834 Don't underestimate landlords. We are rich.  Let's see if renters blink first. Let's see if renters blink first.

|

| 02-06-2009 12:05 PM | |

| Friend-- |

4831 Exactly, the sentiments echo in the market. Landlord ask for sometime high and renter does not want to budge. So we will see if the landlord has more savings or the renter can live in his tent longer. But with more job losses coming, personally I fell that the landlord will have his saving deplicted sooner. |

| 02-06-2009 09:42 AM | |

| landlord-- |

4829 If sellers and landlords can afford to ask for better prices and if there are buyers and tenants willing to bite, why not? To turn it around, I can also claim that it's the buyers and renters who are unrealistic in their expectations. Times have changed. You can no longer find noodles that cost $1 a bowl. |

| 02-06-2009 09:07 AM | |

| Renter-- |

4827 Same thing with the rental market. Property owners continue to be unrealistic with their prices and the agents are making things worse by adding at least 25% on top. This is all psychology i.e. the 5 steps of mourning. Property owners have had it good over the last few years and can't believe that the good times are pretty much over. |

| 02-06-2009 08:14 AM | |

| friend-- |

4825 no wonder my agent friends are looking for jobs. they say the buyers and sellers are simply unrealistic. one side asks for record low prices while the other side asks for the sky. in the end transactions are few and far between. it's little wonder property 'experts' in the news are once again advising that property recovery is a long way to go and sellers better ask for realistic prices if they really want to sell. |

| 02-06-2009 12:45 AM | |

| property-- |

4820 Property market is not hotting up. Its a temporary blip due to the increase in buying from the dramatic crash in the previous quarter. Once this initial buying phase ends (and I believe it has), the prices will continue their fall. Several reasons: excessive quantity, lack of jobs for both locals and expats. |

| 01-06-2009 04:39 PM | |

| Salary.sg |

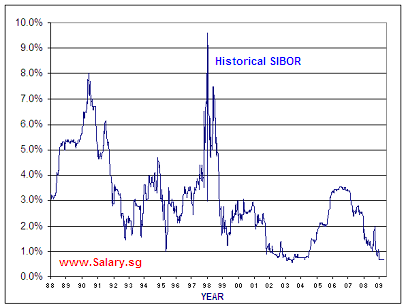

Historical SIBOR (see graph) As the property market heats up again, you may be interested in buying a new home and taking up a Sibor-pegged property loan. Do you know that the 3-month SIBOR rate shot up to an astonishing 9.5% in early 1998? Or that it went to a low of 0.56% in mid-2003? The following chart shows the interesting history of the 3-month Sibor rates:  Banks that offer Sibor-linked home loans include Stanchart, DBS and HSBC. Most of them use the 3-month Sibor, while some also provide a 12-month Sibor option. Use this MAS tool to track the Sibor rate. The 3-month Sibor currently stands at 0.69%. http://www.salary.sg/2009/historical-sibor-see-graph/ |