|

|

24-10-2008, 01:27 AM

|

|

|

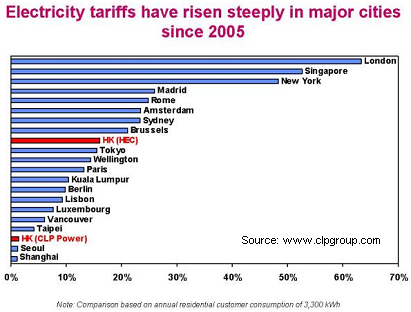

Singapore Number 2 in Raising Electricity Tariffs

Singapore Number 2 in Raising Electricity Tariffs

Once again, we are ranked near the top of the table. But this time, it's for raising electrical tariffs!

HK electricity producer CLP Power released a media statement last month that included a table of 21 major cities ranked by how much electricity tariffs they have raised since 2005.

Thanks to our formidable SP Services, we are ranked No. 2 in hiking the price of electricity.

Singaporeans see an increase in electricity rates that's higher than our friends in 19 other major cities that include New York City, Amsterdam, Sydney, Tokyo, Seoul and Paris.

Ok, let's be fair. It's the price increase that puts us up there.

The article also compares the actual residential tariffs in absolute terms (in HK currency).

Our electricity is the 12th priciest - not too bad - but the following cities charge cheaper rates: HK, Sydney, Seoul, Wellington, Shenzhen, Shanghai, Vancouver, Taipei, Jarkata and KL.

Let's also not forget that CLP Power has just reduced its rates while our friendly SP Services hiked ours by a whopping 21% due to some fancy formula.

We win again!

http://www.salary.sg/2008/singapore-...icity-tariffs/

|

24-10-2008, 11:46 AM

|

|

|

3011

3011

the statistics may be true, but circumstances are that costs for producing energy are much more expensive in sg.

other countries may make use of hydroelectric, nuclear, solar, wind, tidal power, or their reserves of oil, coal and gas, but sg relies only on imports of oil and natural gas.

higher electrical charges do not necessarily mean greater profit for power companies. maybe a comparison of profits by power companies would be more enlightening.

|

24-10-2008, 01:04 PM

|

|

|

3012

3012

Sing Power made S$1B profit after tax for FY07/08 (see their website). ONE BILLION.

No need to compare with others...

|

24-10-2008, 04:54 PM

|

|

|

3013

3013

hm.. if i'm not wrong this $1b figure was arrived at after the sale of fixed assets, and not taking into account the extra requirements for infrastructure changes in the next few years, considering that sg is shifting from oil to natural gas.

the figure is therefore a poor indicator. how much of it is really taken out as dividends? if not much, then most of it is going back to the company for infrastructure purposes.

i'm not happy abt price increases as well, but let's not be myopic.

|

24-10-2008, 07:27 PM

|

|

|

3014

3014

Just looking at the news article, CLP Power is able to give a guaranteed 10% price reduction due to reduced capital expenditure. However, their costs went up by 7%, so they could only give 3% discount.

I didn't try to find out why their cost went up by 7%.

SP Power increased its tariff by "only" 21% even though its cost went up by 38% ($155 vs $112).

If you want to argue, then argue that SP Power should peg its tariff to something else. (Since they weren't very dependent on oil anyway.)

|

24-10-2008, 09:42 PM

|

|

|

3017

3017

Singapore Power has been consistently making S$1 BILLION profits after tax for FY05/06, FY06/07 and FY07/08.

See:

this link

|

24-10-2008, 09:46 PM

|

|

|

3018

3018

the bottom line is: how come HK can do it and not SG?

in my view, they also handle the mini bond saga much better than our world class civil servants and ruling politicians who are the best paid in the world.

|

24-10-2008, 09:49 PM

|

|

|

3019

3019

If not for Tan Kin Lian, the aunties and uncles who invested in Lehman mini bonds would be crying quietly to themselves at home.

|

24-10-2008, 10:14 PM

|

|

|

3020

3020

yes, $1b profits, but are they taken out as dividends for the shareholders or are they pumped back into the company for building infrastructure?

power infrastructure costs, as i see it, are astronomical, and such profits accumulation is needed for the long term.

sidetrack: but why do sgporeans involve the govt in everything? minibonds.. aren't they purely a commercial transaction? if there is misrepresentation, sue. the courts will help you. what can the govt do? slap the dbs managers?

|

25-10-2008, 09:49 AM

|

|

|

3023

3023

Hey Jack, Please do your research first before arguing on "considering that sg is shifting from oil to natural gas.

the figure is therefore a poor indicator."

This is from the Energy Market Authority. "Today, about 80% of Singapore's electricity demand is generated from natural gas" http://www.ema.gov.sg/gas/history.php

Care to respond to that? Your argument on that they "need" to spend their $1B profits on infrastructure so as to shift from oil to gas is FUNDAMENTALLY Flawed when 80% of our electricity is ALREADY generated by natural gas. Please don't tell me that price of natural gas is same as oil. Just because they are both from underground doesn't mean they both costs the same. Don't argue just for the sake of arguing and trying to appear smart to the people who are ignorant on such facts. You just appear to be an empty barrel to me. Arguing on the "Need" to spend on infrastructure when the money was ALREADY SPENT years ago. I'm having my exams now, no time to go thru their financial reports. Will respond to your argument on the sale of fixed assets contributing to the bulk of the after sale profits after 10th nov.

Btw, I'm accounting trained. I wondered whether are you trained in that area too? Do you know the accounting policies regarding sale of fixed assets and how to profits are treated? If not too sure, then please don't sprout your nonsense here after reading from some other website and give a disclaimer like "IF I'm not wrong". I know you're not writing your thesis here but please at least back it up with some evidence or materials.

And lastly, don't get me started on the dividends issue. If I have the money, I would definitely buy lots of Singapore Power shares. I strongly believe that the energies market should be nationalized by the government and not be left to the abuse of the free markets. Didn't Alan Greenspan, the previous FED Reserve chief testify in the US congress on why he was shocked that the free market principle isn't working? Now, let us not forget the lessons learned by the Americans on the ENRON debacle. Seriously Jack, have you even heard of Enron and the whole issue surrounding it? I can recommend you a good film so that you can gain more knowledge before sprouting nonsense here. You're the one who is myopic in view and yet had the cheek to tell others not too. Anyway, enuf of the negative response to your posts. Here's the name of the film. "Enron: The Smartest Guys in the Room". Just watch the trailers on Youtube and you'll get a rough picture of it.

Please feel free to counter my views and points. I look forward to it.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» 30 Recent Threads

» 30 Recent Threads |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|