|

08-06-2009, 06:16 PM

|

|

|

Are you a Prodigious Accumulator of Wealth?

Are you a Prodigious Accumulator of Wealth?

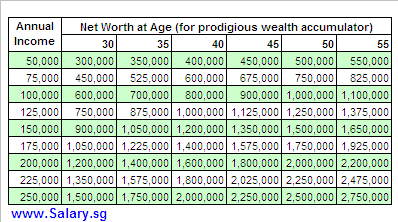

In the book "The Millionaire Next Door", the authors defined prodigious accumulators of wealth as people who manage to accumulate twice their expected net worth.

To calculate your expected net worth, refer to this old Salary.sg post. (Note that I called it "target net worth" previously.)

This chart gives you an idea of how much net worth these so-called prodigious accumulators have:

Are you a prodigious accumulator of wealth? See also related article on Income Benchmarks.

http://www.salary.sg/2009/are-you-a-...tor-of-wealth/

|

08-06-2009, 11:22 PM

|

|

|

4898

4898

Though a significant portion of my net worth is from inheritance, when calculating my net worth I will discount this amount, along with all investment returns resulting from it.

Even without inheritance, for which I grateful to have received, I'm still a prodigious accumulator by the above definition.

|

10-06-2009, 06:21 PM

|

|

|

4913

4913

This formula does not really make sense to me. Say for example for a person who makes $250K a year when he is 40 and has accumulated a networth of $2mil at 40. Assuming no salary increment, his networth is expected to be $2.5mil by 50. That is an incremental networth of only $500K in 10 years or annual networth increase of $50K per year. Given that the person's annual salary is $250K, less of tax of say 20%. Net salary would be around $200K. Saving $50K on a net salary of $200K is too conservative.

Basically, this formula just takes 20% of a person's annual income and add it to the networth. Obviously, a person at higher level of income should have a higher savings rate than a person a lower level of income. So I am not sure if the chart makes too much sense.

|

14-06-2009, 10:56 PM

|

|

Junior Member

|

|

Join Date: Jun 2009

Posts: 3

|

|

Quote:

Originally Posted by James--

This formula does not really make sense to me. Say for example for a person who makes $250K a year when he is 40 and has accumulated a networth of $2mil at 40. Assuming no salary increment, his networth is expected to be $2.5mil by 50. That is an incremental networth of only $500K in 10 years or annual networth increase of $50K per year. Given that the person's annual salary is $250K, less of tax of say 20%. Net salary would be around $200K. Saving $50K on a net salary of $200K is too conservative.

Basically, this formula just takes 20% of a person's annual income and add it to the networth. Obviously, a person at higher level of income should have a higher savings rate than a person a lower level of income. So I am not sure if the chart makes too much sense.

|

I wouldn't assume no salary increment. Realistically, if a person has a net worth of $2mio at 40, he will probably increase his income along the way, whether it's from investments/dividends or from employment.

Someone also posted good comments at the original blog:

Quote:

superman Says:

June 12th, 2009 at 9:07 am e

i think if ‘annual income’ refers to some sort of average annual income over the career life of that person, maybe it makes sense. That might take care of my earlier concern as well as James and Renter’s excellent comments. for example, if a person makes ‘50,000′ annual income at 30, that will imply at 30 his actual annual income has to be higher than 50,000 so that the average annual income at 30 is actually that amount. Another assumption to consider is that the formula works only for steady increase in salary. probably a straight-line type of increase. It doesn’t take into consideration for people who’s salary increase till say 40 and then stays flat for next 10 years.

|

|

29-07-2009, 04:23 PM

|

|

|

The chart does not include inflation rate and it would not be accurate to calculate future value of your present value. Like what others have mentioned, it only take note of stagnant annual income.

|

29-07-2009, 04:23 PM

|

|

|

I think all the numbers are in today’s dollar value to keep things simple.

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» 30 Recent Threads

» 30 Recent Threads |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|