|

|

29-07-2009, 04:28 PM

|

|

Senior Member

|

|

Join Date: Jun 2009

Posts: 45

|

|

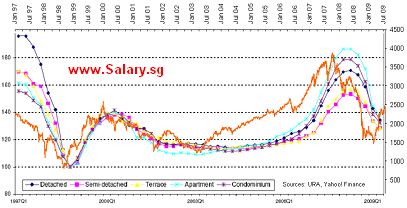

Stocks and Property Recovering (see graph)

Stocks and Property Recovering (see graph)

This recession is perhaps the most “prosperous” recession we have ever seen, thanks to all the liquidity injected into the global monetary system and our government’s pump priming of the local economy with infrastructure projects, jobs credit and low interest rates.

The STI index closed today at a 10-month high of 2,533.43.

And URA reported a better-than-estimated fall in private home prices of 4.7% instead of the 5.9% announced earlier.

Now, I’m not sure if property prices will continue to fall in the next quarter.

* the graph shows relationship between STI graph and URA index graph (the laggard).

But at least one prominent economist has warned of a double dip recession with the second leg coming in late 2010.

Will we see both stocks and property recover the way they did in 1998Q4 to 2000?

Or will the second dip come much earlier to surprise us all?

http://www.salary.sg/2009/stocks-and...ing-see-graph/

|

29-07-2009, 04:31 PM

|

|

|

Of course the current rally is unsustainable. Very simple: we’re heavily export dependent and too small for boosting domestic demand. If USA and Europe economies do not recover and not just their stock markets, we’ll be dead. The current dead cat bounce is the effect of the money pumped into the system. Govt can pump again, but finance minister says there’ll be drastic effects if they keep pumping.

|

29-07-2009, 04:32 PM

|

|

|

The way the property market is rising again is scary. HDB 5-room valuation 627k, closed at 700k.

Insane!

|

29-07-2009, 04:32 PM

|

|

|

If you look at the STI crash of end 97, there’s a sharp V-shape recovery for a short while before retreating to a lower low over 3 quarters. It’s the same this time. After the bailout effects wear off, this bear rally is going to land many kiasu people in hot soup unless they quickly find greater fools to sell their stocks and property to.

|

29-07-2009, 04:34 PM

|

|

|

After the IRs open, foreign funds will flood Singapore and there will be substantial asset inflation. Those who have not invested by then will be left much poorer. The rich get richer. The smart also get richer. The poor and the unsmart get poorer. It’s a fact of life.

|

29-07-2009, 04:34 PM

|

|

|

smartie, a more recent and stronger bear rally is from oct’01 to feb’02, which then decline to a second bottom in apr’03. i think history WILL repeat itself.

|

29-07-2009, 04:37 PM

|

|

|

this recovery is overdone, too much impulsive buying. look at the charts, its a one way up market. its highly unsustainable.

massive monetary n fiscal expansionary policies by govts globally have created a glut of money supply, which supposedly should be flowing to the needy business and people, have been suspected to have flown into assets markets hence driving up the markets.

if these flows continue unabated, it will only result in a greater bubble with only undesirable effects to be seen. all these cries of joy will only end in rivers of tears.

so be careful, jump in now be prepared to jump off anything and fast.

|

29-07-2009, 04:38 PM

|

|

|

Do you recommend that I sell my shares now and pick them up again after the impending correction?

|

29-07-2009, 04:39 PM

|

|

|

risk/reward is subjective.

|

29-07-2009, 04:43 PM

|

|

|

Thanks for the advice. I’ve already sold 1/3 of my shares with the intention to buy back at a lower price.

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» 30 Recent Threads

» 30 Recent Threads |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|